Flexible Spending Accounts (FSAs)

HSHS offers two flexible spending accounts:

- Health Care FSA.

- Dependent Care FSA.

These accounts are designed to let you pay for specific health care and dependent day care expenses on a pre-tax basis. By contributing to an FSA, you can reimburse yourself for eligible expenses with untaxed money, including federal, Social Security and, in most states, state and local taxes. That can help you make your income go farther.

New in 2024: Health Equity will be administering the HSHS FSA acounts.

How FSAs Work

- When you enroll, you decide how much to set aside in your account(s) during the calendar year for:

- Health care expenses for services you or your dependents receive between January 1, 2024 and March 15, 2025.

- Dependent day care expenses for services you receive between January 1, 2024 and December 31, 2024.

- You contribute to the account(s) with pre-tax dollars deducted from your paycheck. This lowers your taxable income, and you don’t pay taxes on the money you use from your account(s).

- When you have an eligible expense, you file a claim to reimburse yourself from your account.

- Watch a brief video on the advantages of participating in a Flexible Spending Account.

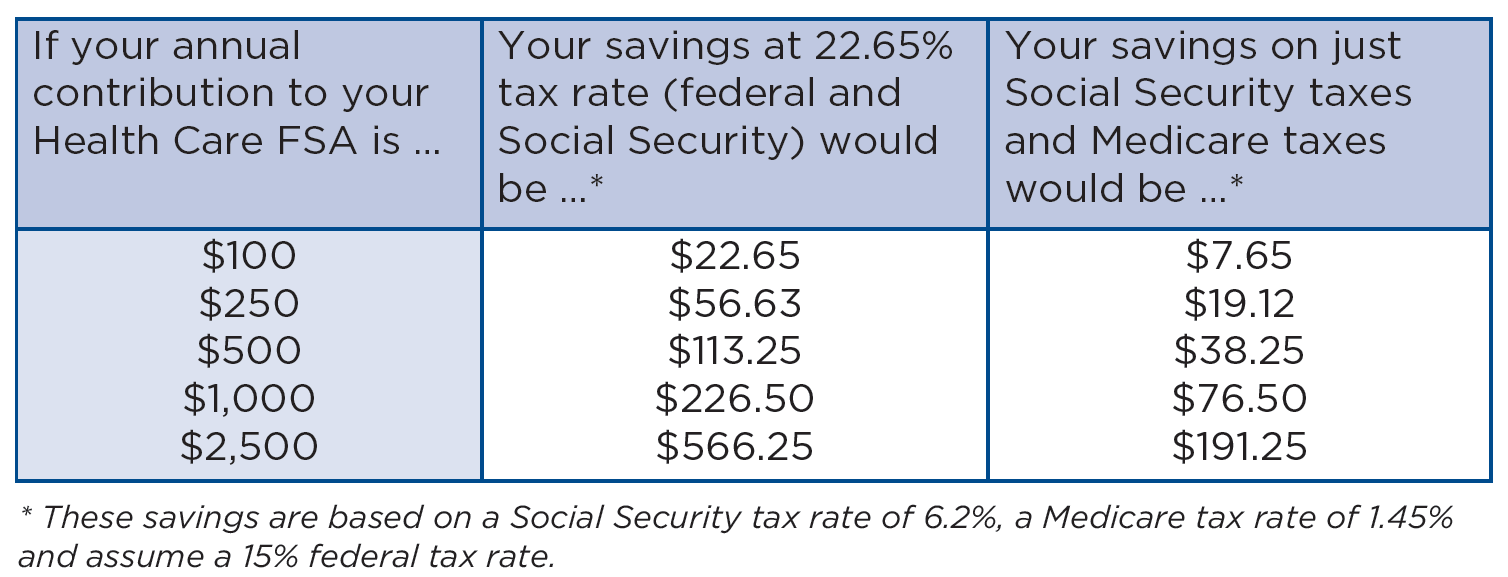

FSAs are like a sale. Money you set aside in the accounts is taken off the top of your pay before taxes are withheld. If you pay income taxes and Social Security taxes, at a minimum this is probably like a “20% sale” on most of the health or dependent care services you buy. The savings could be more – depending on your income tax rate. And, even when you pay no income taxes, the Social Security tax savings is likely to be more than 7.65% – or $7.65 for each $100 you spend.

Important Information about FSAs

- You may change those amounts during the year only if you have a qualified change in family or

employment status that allows you to do so.

- Under federal "use it or lose it" rules, if you don't use all the money in your FSA for services during the covered time period, you forfeit unused dollars. You have until the annual claim deadline to submit a claim for reimbursement.

- Cannot be enrolled in a FSA if actively contirbuting to a Health Savings Account (HSA).

Health Care FSA

Information about eligible Health Care FSA expenses can be found in the IRS 502 Publication. Medical premiums are not eligible. In addition, for ethical and philosophical reasons, abortions, sterilizations, contraceptives, sexual reassignment, in-vitro fertilization, artificial insemination, and embryonic implantation procedures will not be allowed as reimbursable expenses.

Dependent Care FSA

Due to the IRS "use it or lose it" rule, you will forfeit any money in excess of the qualified expenses you incur between January 1, 2024 and December 31, 2024 that you submit by the May 1, 2025 claim filing deadline.

Important: Unlike the FSA, annual DCRA funds are not available upfront. Funds are only accessible as they are deposited with each payroll deduction.

Also, keep in mind that you may be eligible to take advantage of the federal tax credit for child and dependent care as an alternative to using the Dependent Care Reimbursement Account. You may wish to consult a tax advisor to determine whether the federal tax credit or Dependent Care Reimbursement Account is best for you.

Resources

Health Equity Resource Site