HSHS Pension

What is the HSHS Final Average Pay Pension Plan? What is my cost for the plan?

- The HSHS Traditional Final Average Pay Pension Plan applies to colleagues hired prior to July 1, 2014 and is a defined benefit pension plan that provides you with a source of regular income during retirement.

- You will be eligible to receive a pension benefit if you have at least five years of credited service when you retire or terminate employment, and you are at least age 55 and your employment ends.

- The HSHS Pension Plan is free. There is no cost to you. Your employer makes all the contributions necessary to provide your retirement benefits.

What is the HSHS Pension Portal?

The HSHS Pension Portal is a online portal for HSHS pension plan participants.

What happened to the HSHS Cash Balance Pension Plan?

Active colleagues under the HSHS Employer Contribution Retirement 401(a) Plan, previously known as the HSHS Cash Balance Pension Plan (hired/rehired on or after July 1, 2014) had their pension benefits frozen as of December 31, 2022, and their assets were transferred to their 403(b) account with Fidelity Investments in Spring 2023.

Effective January 1, 2023, they stopped earning additional benefits in the HSHS Cash Balance Pension Plan and became eligible for the HSHS Employer Contribution Retirement 401(a) Plan and matching employer contributions to the 403(b) Plan.

For those eligible to receive a 401(a) employer contribution and 403(b) employer matching contribution, they can expect to see those contributions applied by no later than March 15, 2024.

Who is eligible to use the HSHS Pension Portal?

All HSHS Pension plan participants (active and term-vested) will have access to the Penison portal. In addition, alternate payees, surviving spouses, and beneficiaries in pay status will also have access.

*Please note, Colleagues who have not been employed at an HSHS ministry for a minimum of 12 months and/or have yet to work 1,000 hours or more in a calendar year will not have access to the online pension portal.

What is the HSHS Final Average Pay Pension Plan based on?

Your pension benefit is based on three factors:

- Credited Service - Your credited service is the number of calendar years in which you are paid for 1,000 hours of service. This corresponds to the wages reported annually on your W-2 form. You receive partial years of credited service for your first and last calendar years of employment if you have not earned the full 1,000 hours.

- Final Average Pay - This is the average of your earnings for the five highest-paid consecutive completed calendar years of service within the last 15 completed calendar years of service. Your earnings are your W-2 earnings, plus any salary reduction contributions to the 403b retirement savings plan and any pre-tax deductions to the HSHS Flexplan.

- Excess Pay - Excess pay is the portion of your final average pay that exceeds 30% of the Social Security taxable wage base in the previous calendar year.

What is the HSHS Employer Contribution Retirement (401(a) Plan)?

The HSHS Employer Contribution Retirement Plan (401(a) plan) is an important source of your overall retirement income, funded entirely by HSHS. It rewards your service with higher contributions as your years of service increase and forms the foundation of the retirement income you build. If eligible, you are automatically enrolled.

What’s in it for me?

- An account balance that can grow through contributions from HSHS and investment earnings (depending on performance of the investments you choose).

- Higher contributions over time to reward your service.

- A benefit you can take with you if you terminate employment with HSHS after three years of vesting service.

How does the HSHS Employer Contribution Retirement (401(a) Plan) grow?

Your 401(a) plan account grows through:

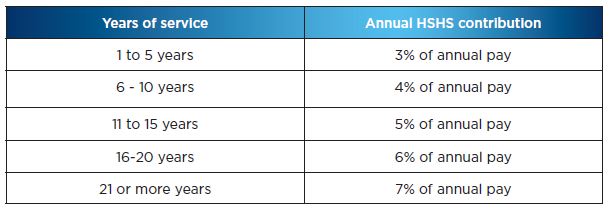

- HSHS contributions of 3% to 7% of your eligible pay, depending on your years of service.

- Investment earnings.

You are fully vested (100%) in all contributions after

three years of vesting service. HSHS service prior to 2023 counts toward your contribution percentage and your vesting service.

Is my pension benefit safe?

Yes! Your pension benefit is safe.

- Hospital Sisters Health System has several checks and balances in place to safeguard your accrued pension benefit.

- Each year your employer deposits funds into a pension plan trust account to cover the pension benefits that have accrued for its employees during the year.

- Each year independent auditors check the books to be sure the funds have been deposited and are being safeguarded.

- HSHS also has pension actuaries who tell us how much money must be deposited each year to provide the benefits that have been accrued and promised.

Am I required to use the Pension portal?

No. You still have access to a dedicated HSHS Pension Service Center team who can help you with any questions or needs that you may have. You can contact your Pension Representatives at 1-855-394-4747 – Option #1) Monday – Friday 8:00am – 5:00pm (CST).

How can I access the HSHS Pension portal?

You can access the portal anytime from anywhere using any device (including mobile) with internet access. Login and register at

http://benefits.hshs.org/pension.

How is the HSHS Final Average Pay Pension benefit paid?

There are two basic forms of HSHS pension benefit payment, depending on your marital status:

- If you are single, the basic form of payment is a monthly income for life, with no survivor benefits.

- If you are married, the basic payment method is a Qualified Joint and Survivor Annuity. Under this form, you will receive a reduced monthly benefit for life. After your death, your spouse will receive benefits for life equal to half the amount you were receiving. Married persons can also elect the basic benefit for single persons if they have spousal consent.

If you do not want one of the basic forms of payment, you may choose one of the optional methods. If you are married, your spouse must consent to your selecting an optional form of payment. His or her consent must be in writing and be witnessed by a notary public. Options available to you are:

- A monthly income for life, with guaranteed payments up to 10 years. Any guaranteed payments remaining at your death will be paid to your beneficiary. If no guaranteed payments remain, there will be no survivor benefit.

- A joint and survivor annuity that pays you a reduced monthly income for life, with either 50 percent, 75 percent, or 100 percent of that amount continuing to your spouse or other designated beneficiary after your death.

How do the HSHS contribution credits work?

Annual contributions are a percentage of your eligible pay and is the amount HSHS adds to your account for each calendar year in which you are paid for at least 1,000 hours. Your contribution percentage depends on your years of service as of the end of the current year. The following chart shows how contribution percentages for each year are determined based on your service as of December 31 of the current year.

How and when can I receive my 401(a) Plan balance?

If you are vested with three years of vesting service, you may receive your benefit when you terminate employment with HSHS. You may take a lump sum or an alternate form available from Fidelity, such as installments. You can also delay distribution to a later date.

What is required to register my account?

As part of the registration process, you will be prompted to set up a username and password. Your username must be an active email address that you are able to access, and your password will need to meet a minimum set of requirements, which will be specified during the registration process. As part of our Multifactor Authentication process, you will also be asked to provide at least one secondary contact method. This can either be another email address or a phone number that can be used to send a temporary numeric code to validate your identity,

Is the HSHS Final Average Pay Pension Plan freezing?

Active colleagues under the HSHS Traditional FAP Pension Plan (hired prior to July 1, 2014) will have their pension benefits frozen as of December 31, 2023. Starting January 1, 2024, they will stop earning additional benefits in the HSHS FAP Pension Plan and will become eligible for the HSHS Employer Contribution Retirement 401(a) Plan and matching employer contributions to the 403(b) Plan, both managed entirely by Fidelity Investments.

Reminder: Because colleagues may have earned an additional year of service toward their benefit for 2023, an exact pension lump sum present value calculation will not be available until the end of January/early February. Colleagues going through the transition will be sent additional information to their home mailing address in late January/early February informing of their final pension benefit, information on their new 401(a) and 403(b) match benefit, and a timeline for next steps and important dates.

Will I still have access to the HSHS Pension Portal if I retire or leave employment from HSHS?

Yes. If you are a vested participant in the HSHS Pension Plan (Traditional), you will continue to have access to your HSHS Pension benefits until 7/1/2024.

I worked for HSHS, left employment and was later rehired, does my prior service count towards vesting in the HSHS Employer Contribution Retirement (401(a) Plan)?

If you are rehired on or after July 1, 2014, you are eligible to begin earning a 401(a) plan benefit as described in this guide if you are employed on or after January 1, 2023. Any previous years of service for which you retain credit will count toward vesting in the 401(a) plan benefit and the annual HSHS contribution percentage.