HSHS Employer Contribution Retirement 401(a) Plan (hired/rehired after 7/1/2014)

What happened to the HSHS Cash Balance Pension Plan?

Active colleagues under the HSHS Employer Contribution Retirement 401(a) Plan, previously known as the HSHS Cash Balance Pension Plan (hired/rehired on or after July 1, 2014) had their pension benefits frozen as of December 31, 2022, and their assets were transferred to their 403(b) account with Fidelity Investments in Spring 2023.

Effective January 1, 2023, they stopped earning additional benefits in the HSHS Cash Balance Pension Plan and became eligible for the HSHS Employer Contribution Retirement 401(a) Plan and matching employer contributions to the 403(b) Plan.

For those eligible to receive a 401(a) employer contribution and 403(b) employer matching contribution, they can expect to see those contributions applied by no later than March 15, 2024.

What is the HSHS Employer Contribution Retirement (401(a) Plan)?

The HSHS Employer Contribution Retirement Plan (401(a) plan) is an important source of your overall retirement income, funded entirely by HSHS. It rewards your service with higher contributions as your years of service increase and forms the foundation of the retirement income you build. If eligible, you are automatically enrolled.

What’s in it for me?

- An account balance that can grow through contributions from HSHS and investment earnings (depending on performance of the investments you choose).

- Higher contributions over time to reward your service.

- A benefit you can take with you if you terminate employment with HSHS after three years of vesting service.

How does the HSHS Employer Contribution Retirement (401(a) Plan) grow?

Your 401(a) plan account grows through:

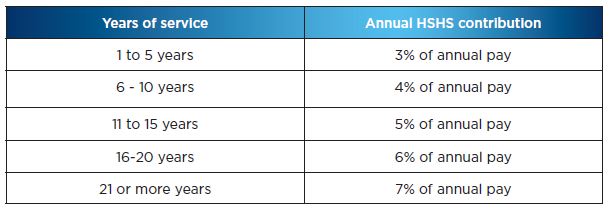

- HSHS contributions of 3% to 7% of your eligible pay, depending on your years of service.

- Investment earnings.

You are fully vested (100%) in all contributions after

three years of vesting service. HSHS service prior to 2023 counts toward your contribution percentage and your vesting service.

How do the HSHS contribution credits work?

Annual contributions are a percentage of your eligible pay and is the amount HSHS adds to your account for each calendar year in which you are paid for at least 1,000 hours. Your contribution percentage depends on your years of service as of the end of the current year. The following chart shows how contribution percentages for each year are determined based on your service as of December 31 of the current year.

How and when can I receive my 401(a) Plan balance?

If you are vested with three years of vesting service, you may receive your benefit when you terminate employment with HSHS. You may take a lump sum or an alternate form available from Fidelity, such as installments. You can also delay distribution to a later date.

I worked for HSHS, left employment and was later rehired, does my prior service count towards vesting in the HSHS Employer Contribution Retirement (401(a) Plan)?

If you are rehired on or after July 1, 2014, you are eligible to begin earning a 401(a) plan benefit as described in this guide if you are employed on or after January 1, 2023. Any previous years of service for which you retain credit will count toward vesting in the 401(a) plan benefit and the annual HSHS contribution percentage.