FAQs

What is the difference between the Basic and High dental insurance options?

Basic Dental insurance option for 2024:

- $50 per covered person annual deductible

- $150 annual family deductible

- $1,000 yearly maximum per person on dental treatment

- The Basic option does not cover orthodontia

High Dental insurance option for 2024:

- $25 per covered person annual deductible

- $75 annual family deductible

- $2,000 yearly maximum per person on dental treatment

- The High option also covers orthodontia with an additional $25 per covered person deductible and a separate lifetime maximum of $1,500 for orthodontia services per person. Implants are covered at 50% after deductible under the High option.

When does health insurance coverage begin?

Your coverage will begin on the 1st of the month on or after your hire date. This applies if you are a newly hired colleague or have transferred from a PRN position to a benefits-eligible position. Coverage for your dependents begins on the same day as your coverage as long as you have enrolled them for health insurance.

Why does HSHS require mandatory mail order for prescription maintenance meds?

The HSHS Healthy Plan provides insurance coverage to over 23,000 covered members (colleagues and their families). In order to continue to provide this benefit, it’s imperative that HSHS control health care costs for its colleagues. Because HSHS is self-insured, the amount of money the System and colleagues pay toward our medical and pharmacy insurance must cover our claims costs. Prescription drug claims are a significant portion of health care costs and are projected to continue to rise.

HSHS examined many factors prior to its decision in 2011 to mandate mail service for maintenance medication. After exploring different options, it was determined that mail service was a cost-effective solution to controlling costs because it eliminates dispensing fees and the drug price is generally lower due to the bulk purchases. Mail service also offers the convenience of a 90-day supply of medication and home delivery at no cost to the member.

You will be able to fill a 90-day supply of non-specialty prescription drugs using Walgreens, in addition to HSHS pharmacies and the OptumRx mail order service.

What is the advantage for using mail service for prescription maintenance drugs?

There are three advantages:

- You are very likely to save money on your prescriptions. While the plan options pay the same percentage of the cost, the overall cost is generally lower with mail order because the mail service program can purchase medications in very large quantities. And, there is no dispensing fee included in the cost of mail service prescriptions, while a dispensing fee is included in each 30-day retail prescription.

- You have the convenience of home delivery. Medications are delivered directly to your home or another address you specify within 5 days after your order is received, with no charge for standard delivery.

- Maintenance medications will not be covered after the third fill at a retail pharmacy. They are covered when filled through the Plan’s mail service pharmacy or an HSHS pharmacy (if there is one located in your area).

What is a flexible spending account (FSA)?

The HSHS benefit plan offers two flexible spending accounts:

- Health Care FSA

- Dependent Care FSA

FSAs are like a sale. Money you set aside in the accounts is taken off the top of your pay before taxes are withheld. You contribute to the account(s) with pre-tax dollars deducted from your paycheck. This lowers your taxable income, and you don’t pay taxes on the money you use from your account(s). When you enroll, you decide how much to set aside in your account(s) during the 2024 calendar year for:

- Health care expenses for services you or your dependents receive between January 1, 2024, and March 15, 2025.

- Dependent day care expenses for services you receive between January 1, 2024, and December 31, 2024.

When you have an eligible expense, you file a claim to reimburse yourself from your account. For the Dependent Care FSA, it’s important to compare the tax savings you might have under the FSA to what you might save using the federal dependent day care tax credit.

What are the Basic Life Insurance and Supplemental Life Insurance benefits and who is eligible?

HSHS provides basic life insurance with built-in accidental death & dismemberment (AD&D) coverage at no cost to you.

- You automatically receive 1 ½ times your annual salary up to a maximum of $50,000. No evidence of insurability is required.

- Basic life insurance is provided to all active colleagues of an HSHS facility who are regularly scheduled/budgeted to work 32 or more hours per biweekly pay period.

- Temporary or leased colleagues are not eligible for life insurance.

Benefit eligible colleagues may purchase additional supplemental life insurance through Securian for yourself, your spouse, and/or your dependent children who are under age 26.

- Supplemental life insurance for you is one to eight times your annual salary up to a maximum of $1 million.

- Supplemental life insurance for your spouse is in $5,000 increments up to a maximum of $50,000.

- Note: As required by law, you cannot carry more life insurance on your spouse than you carry for yourself (Basic life and supplemental life combined).

- Supplemental life insurance for your eligible dependent children is in $2,500 increments up to a maximum of $10,000.

- When you select supplemental life insurance for your eligible dependent children, each child is covered for the same amount.

- Note: Your first eligible newborn child will automatically be covered for $2,500 for 30 days from live birth, unless or until you enroll for a different amount of dependent child life insurance. If you do not enroll within 30 days, such coverage will automatically terminate.

What is Long Term Disability (LTD) Insurance and how much is the benefit?

Long Term Disability (LTD) Insurance is insurance that provides 60% of your salary, up to a monthly maximum of $10,000, in the event you become disabled due to illness or injury.

This is money that you can use to pay your expenses while you are disabled and unable to work.

Note: The amount you receive from LTD insurance is adjusted if you receive benefits or disability income from other sources such as Social Security or Worker’s Compensation. However, regardless of the benefits you receive from other sources, the minimum benefit payable from LTD insurance is 10% of your gross benefit or $100, whichever is greater.

What is short term disability (STD) benefit and who is eligible?

- The Short Term Disability Income Protection Plan (STD) is sponsored by HSHS to replace a portion of your income (70%) in the event you are unable to work due to an illness or injury.

- The STD benefit does not provide benefits for occupational (work related) illness or injury or to care for an ill or injured family member.

- You are eligible for STD benefits if you are a regular active colleague of an HSHS facility and regularly scheduled/budgeted to work 32 or more hours per biweekly pay period.

- Temporary or leased colleagues are not eligible for STD benefits.

- Coverage in the Short Term Disability Income Protection Plan will begin after you complete 90 days of active employment.

What is the HSHS Final Average Pay Pension Plan? What is my cost for the plan?

- The HSHS Traditional Final Average Pay Pension Plan applies to colleagues hired prior to July 1, 2014 and is a defined benefit pension plan that provides you with a source of regular income during retirement.

- You will be eligible to receive a pension benefit if you have at least five years of credited service when you retire or terminate employment, and you are at least age 55 and your employment ends.

- The HSHS Pension Plan is free. There is no cost to you. Your employer makes all the contributions necessary to provide your retirement benefits.

What does the VSP Vision Plan cover?

The VSP Vision Plan provides coverage for eye exams, lenses, frames and contact lenses plus discounts on many vision services and products. No deductible applies to VSP vision benefits.

- For Wisconsin colleagues, the HSHS VSP option covers eye exams performed by Prevea vision providers.

Click

here to see a chart that highlights some commonly used services and shows the vision plan’s benefits.

Who is eligible for paid time off (PTO)?

- Colleagues who are regularly scheduled to work 32 hours or more per biweekly pay period are eligible for PTO.

- Temporary and PRN colleagues are not eligible for the program.

How does the LiveWELL program work? What are the rewards/incentives for participating in the program

The LiveWELL wellness program is designed to empower you to live a life that’s healthy, active and rewarding, so you can be a better role model for our patients and set a higher standard for the future of health care at HSHS.

You will have the opportunity to complete activities to earn FastCash rewards to improve your physical, emotional, financial and work well-being.

What is the HSHS Discount Program?

The HSHS Discount Program is a one-stop shop for exclusive discounts at some of your favorite merchants in travel, computers, tickets and more! All HSHS colleagues will now have access to thousands of exclusive discounts. Visit hshs.perkspot.com to register.

- While it is important that you register using your six digit HSHS colleague ID number, you may use any email address you prefer.

- After you complete the registration process, your access to great discounts and savings will begin!

To find more information about the program, please contact PerkSpot customer service at cs@perkspot.com or (866) 606-6057.

How do I access my Total Compensation Statement?

The Total Compensation Statements are available in the document repository through colleague Self Service in PeopleSoft. To access your document library please use the following steps:

- Log onto PeopleSoft

- Click Self Service

- Click ESS Document Repository

- Under Document Type select the requested statement - Benefits Statement (Total Compensation)

- Select "View" next to the document you wish to view and/or print. The most recent document will be at the top of the list.

Where can I find more information on the HSHS Student Loan Repayment Program?

Click

here to access the HSHS Student Loan Repayment Program FAQs.

What is the HSHS Pension Portal?

The HSHS Pension Portal is a online portal for HSHS pension plan participants.

OptumRx is your plan’s pharmacy care services manager. Our commitment is to help you get the most out of your prescription medication benefit. We provide safe, easy and cost-effective ways for you to get the medication you need.

Who is eligible for the HSHS Education Assistance Program?

HSHS Colleagues who are actively employed and budgeted at least 32 hours per pay period are eligible to participate in the program. Colleagues must also be in good standing and have no formal performance corrective action plan or counseling within the last 12-months.

There is no waiting period before eligible colleagues may apply for HSHS Education Assistance.

How do I find an in-network provider (UMR)?

To locate an in-network provider,

CLICK HERE.

For help determining which network service area you are in, see the

2024 HSHS Benefits Guide.

If you have a dependent who lives outside of the network area, such as a child attending college, you can register your dependent with UMR after you receive your ID card. Call UMR to get started (1-800-221-6346).

Once your dependet is registered, they will receive the HSHS Extended benefit level for all in-network services.

and/or your out-of-area covered dependent must complete and submit the

Care Package Form in order to have additional providers available to your out-fo-area covered dependent in the First Health Network. The Care Package Form must be completed and submitted before receiving any services.

How do I designate my beneficiary?

If you have not already selected your beneficiaries, or if you have experienced a life-changing event such as a marriage, divorce, birth of a child, or a death in the family, it’s time to consider your beneficiary designations. Fidelity’s Online Beneficiaries Service offers a straightforward, convenient process that takes just minutes. To make your elections, click

HERE, then click on the “Profile” link, then select “Beneficiaries” and follow the online instructions.

What happened to the HSHS Cash Balance Pension Plan?

Active colleagues under the HSHS Employer Contribution Retirement 401(a) Plan, previously known as the HSHS Cash Balance Pension Plan (hired/rehired on or after July 1, 2014) had their pension benefits frozen as of December 31, 2022, and their assets were transferred to their 403(b) account with Fidelity Investments in Spring 2023.

Effective January 1, 2023, they stopped earning additional benefits in the HSHS Cash Balance Pension Plan and became eligible for the HSHS Employer Contribution Retirement 401(a) Plan and matching employer contributions to the 403(b) Plan.

For those eligible to receive a 401(a) employer contribution and 403(b) employer matching contribution, they can expect to see those contributions applied by no later than March 15, 2024.

How much financial assistance is available?

Under the HSHS Education Assistance policy, colleagues can receive up to $4,000 of educational assistance each calendar year. The maximum annual allowance will be based on budgeted biweekly hours at the time of application.

| Hours |

Max Annual Allowance |

| 72-80 |

$4,000 |

| 48-71 |

$3,000 |

| 32-47 |

$2,000 |

With OptumRx, can I continue to go to the same pharmacy?

You will have access to OptumRx® home delivery and a large network of retail pharmacies, including large national chains and many local pharmacies. Go online or call us to help find a network pharmacy. You can also fill your prescription at an HSHS pharmacy.

You will be able to fill a 90-day supply of non-specialty prescription drugs using Walgreens, in addition to HSHS pharmacies and the OptumRx mail order service.

What is the “Total Compensation Statement”?

- The “total compensation statement” is a personal benefit statement that provides you with detailed information regarding the cost of your benefits, PTO, short term disability/EIB, and annual salary.

- The hidden benefit costs that are paid by your employer are compared to your costs.

- The hidden paycheck allows you to see how much your employer has added to your total compensation through the wide range of benefits that are provided by HSHS.

Who is eligible for the HSHS Student Loan Repayment Program?

HSHS full time (regularly scheduled/budgeted to work 36 or more hours a week) Registered Nurses, Advanced Practice Nurses, Physician Assistants and Certified Registered Nurse Anesthetists (CRNA) starting January 1, 2019.

RNs are limited to the following job codes:

2410: RN

2412: RN/Clinic

2413: RN/Critical Care

2464: RN/Telehealth

2561: RN/License Pending

2493: Facilitator/Clinical RN

2522: RN/Flight Nurse

2560: RN/First Assist

2697: RN/Physician Practice

2781: RN/Float

2911: Facilitator/Clinical Nursing

2100: RN/Occ. Health

Who is eligible to use the HSHS Pension Portal?

All HSHS Pension plan participants (active and term-vested) will have access to the Penison portal. In addition, alternate payees, surviving spouses, and beneficiaries in pay status will also have access.

*Please note, Colleagues who have not been employed at an HSHS ministry for a minimum of 12 months and/or have yet to work 1,000 hours or more in a calendar year will not have access to the online pension portal.

How do I stop getting emails from PerkSpot?

You are able to opt out of email communications either by clicking “Unsubscribe” at the bottom of PerkSpot emails, or by going into “My Account” once you have completed registration and updating your email preferences.

How much Paid Time Off (PTO) time do I accrue?

- You begin accumulating PTO on your first day of employment.

- Accrual of PTO is based upon length of continuous service and actual hours paid, up to 2080 hours per payroll calendar year.

- Part-time colleagues accrue PTO on a pro-rated basis, based on hours paid per year.

- PTO is accrued on: straight time, overtime, premium pay, on call time worked, bereavement, PTO, OWB, and Jury Duty.

- Upon reaching a PTO balance of two times the annual accrual rate, the colleague stops accumulating PTO hours until some PTO is used.

- For more information on PTO accrual, CLICK HERE.

Who is eligible for HSHS LiveWELL?

LiveWELL is available to all HSHS benefit-eligible colleagues (scheduled/budgeted to work 16 or more hours per week).

Where can I find out what my Vision plan contributions are?

- The VSP Vision plan contributions can be found within the chart below.

- They can also be located within the 2024 HSHS Benefit Guide.

2024 Biweekly VSP Vision Plan Contributions

| Colleague Contributions |

| Colleague Only |

Colleague + Spouse/LDA |

Colleague + Child(ren) |

Colleague + Spouse/LDA + Child(ren) |

| $3.55 |

$7.09 |

$7.59 |

$12.12 |

What is the HSHS Employer Contribution Retirement (401(a) Plan)?

The HSHS Employer Contribution Retirement Plan (401(a) plan) is an important source of your overall retirement income, funded entirely by HSHS. It rewards your service with higher contributions as your years of service increase and forms the foundation of the retirement income you build. If eligible, you are automatically enrolled.

What’s in it for me?

- An account balance that can grow through contributions from HSHS and investment earnings (depending on performance of the investments you choose).

- Higher contributions over time to reward your service.

- A benefit you can take with you if you terminate employment with HSHS after three years of vesting service.

What is the HSHS Final Average Pay Pension Plan based on?

Your pension benefit is based on three factors:

- Credited Service - Your credited service is the number of calendar years in which you are paid for 1,000 hours of service. This corresponds to the wages reported annually on your W-2 form. You receive partial years of credited service for your first and last calendar years of employment if you have not earned the full 1,000 hours.

- Final Average Pay - This is the average of your earnings for the five highest-paid consecutive completed calendar years of service within the last 15 completed calendar years of service. Your earnings are your W-2 earnings, plus any salary reduction contributions to the 403b retirement savings plan and any pre-tax deductions to the HSHS Flexplan.

- Excess Pay - Excess pay is the portion of your final average pay that exceeds 30% of the Social Security taxable wage base in the previous calendar year.

What is a 403b retirement savings plan?

- A 403b tax deferred annuity is a retirement savings program that allows eligible HSHS colleagues to set aside a portion of their income on a pre-tax basis.

- It is also known as a Tax Sheltered Annuity (TSA).

- This reduces current federal income taxes, and, in most states, state income tax.

- The 403b retirement plan is a convenient way to save for retirement through payroll deduction and offers flexible options for receiving your money when you retire.

How long are LTD benefits paid?

- The duration of benefits is based on your age when you become disabled.

- Your LTD benefits are payable for the period during which you continue to meet the definition of disability.

- If your disability occurs before age 60, benefits will be paid to a maximum of age 65.

- If you become disabled at or after age 60, benefits would be paid according to a benefit duration schedule found in the LTD insurance summary plan description booklet.

How do I file a request/claim for short term disability or EIB benefits?

The claim submission process for STD is telephonic.

- Contact Unum at 866-295-3007 and provide the requested information to start your claim.

- The STD policy # is 92707.

- Unum will send a packet of information to your home address.

- Follow the directions on each form contained in the packet.

- If you are unable to report for work, you must also notify your supervisor as soon as possible, prior to the start of your shift.

When is an Evidence of Insurability (EOI) form required for supplemental life insurance?

You must complete the EOI form if, as a newly eligible colleague, you elect coverage that exceeds three times your pay or $350,000 or elect coverage for your spouse that exceeds $20,000.

- Securian will send an email to your personal email directing you to Securian Financial’s website to complete your EOI. If you do not have a personal email on file a EOI form will be mailed to our home address.

- Elected coverage will become effective only if you complete the EOI online process or form and Securian has approved the coverage.

If you are a late entrant (previously waived coverage) and want to elect coverage, increase your current coverage more than one level, or add or increase spouse coverage, you will be required to complete the EOI process via online or form if you wish to make these changes during annual enrollment.

- Securian will send an email to your personal email directing you to Securian Financial’s website to complete your EOI. If you do not have a personal email on file a EOI form will be mailed to our home address.

- Elected coverage will become effective only if you complete the EOI online process or form and Securian has approved the coverage.

Note:

Occasionally, during annual enrollment there may be an opportunity to choose employee supplemental life insurance coverage that is one level higher than your current coverage (e.g., from five to six times pay), you will

not be required to provide Evidence of Insurability (EOI) to Securian.

You will be notified of this opportunity when annual enrollment information is sent out.

Evidence of insurability (EOI) is not required to enroll dependent children in supplemental life insurance.

What if I don’t use mail service for my maintenance medications?

- You may fill your maintenance prescription two times at a retail pharmacy.

- After a maintenance prescription is filled twice at a retail pharmacy, you must use mail service for subsequent refills to be covered by the HSHS Healthy Plan's prescription drug coverage.

How much can I contribute to a Flexible Spending Account (FSA)?

- The minimum contribution amount is $5 per biweekly pay period.

- The maximum contribution for the dependent care (DCRA) FSA is $5,000 per year. If you file your federal income tax as “married filing separately,” the maximum amount that you may deposit into the dependent care FSA is $2,500 per year.

- The maximum contribution amount for the health care (HCRA) FSA is $3,200 for 2024.

What is the advantage of using mail service for prescription maintenance drugs?

There are three advantages:

- You are very likely to save money on your prescriptions. While the plan options pay the same percentage of the cost, the overall cost is generally lower with mail order because the mail service program can purchase medications in very large quantities. And, there is no dispensing fee included in the cost of mail service prescriptions, while a dispensing fee is included in each 30-day retail prescription.

- You have the convenience of home delivery. Medications are delivered directly to your home or another address you specify within 5 days after your order is received, with no charge for standard delivery.

- Maintenance medications will not be covered after the third fill at a retail pharmacy. They are covered when filled through the Plan’s mail service pharmacy or an HSHS pharmacy (if there is one located in your area).

You will be able to fill a 90-day supply of non-specialty prescription drugs using Walgreens, in addition to HSHS pharmacies and the OptumRx mail order service.

If I do not enroll by my enrollment deadline, what coverage will I have?

If you are a new hire and you do not enroll by your enrollment deadline, you will have the following coverage by default:

- Basic Life and AD&D insurance

- Short-Term Disability Coverage

- Long-Term Disability Coverage

When does health insurance coverage begin?

Your coverage will begin on the 1st of the month on or after your hire date. This applies if you are a newly hired colleague or have transferred from a PRN position to a benefits-eligible position. Coverage for your dependents begins on the same day as your coverage as long as you have enrolled them for health insurance.

How many dental cleanings are covered per year and how often can I go?

- The HSHS Dental Insurance Plan provides coverage for up to two exams and up to two cleanings in a calendar year.

- You are not required to wait six months between dental cleanings.

Is orthodontia a covered expense by the dental insurance plan and how much is covered?

The high option of the HSHS Dental Insurance Plan includes coverage for orthodontia services.

Under the high option:

- Orthodontia services are covered at 50% after deductible with a lifetime maximum of $1,500 per covered member.

- This lifetime maximum does not apply towards your yearly maximum benefits for all other dental services under this option.

- Provides for a preliminary study which includes x-rays, diagnostic costs and a treatment plan.

- The first month of active treatment and retention appliances are also covered.

What about emergency room care?

You will have a $100 copayment for emergency services. This is in addition to your deductible and coinsurance for the medical plan option you select.

If I do not enroll by my enrollment deadline, what coverage will I have?

If you are a new hire and you do not enroll by your enrollment deadline, you will have the following coverage by default:

- Basic Life and AD&D insurance

- Short-Term Disability Coverage

- Long-Term Disability Coverage

What if I don't use mail service for my maintenance medications?

After a maintenance prescription is filled twice at a retail pharmacy, you must use an HSHS pharmacy or mail service for subsequent refills to be covered by the HSHS medical plan’s prescription drug coverage.

You will be able to fill a 90-day supply of non-specialty prescription drugs using Walgreens, in addition to HSHS pharmacies and the OptumRx mail order service.

How do I get started with prescription drug mail service through Costco (Navitus)?

You will need to register with Costco by visiting www.pharmacy.costco.com or by calling 1-800-607-6861 before you can fill and manage your mail order prescriptions.

- When registering, you should have your Dean Health Plan ID card, and have your doctor prescribe a 90-day prescription plus refills for up to one year (if applicable).

- Once you have registered, mail your completed “Patient Profile Form” along with your 90-day prescription and payment method to Costco Mail Order, 215 Deininger Circle, Corona, CA 92880.

If you have any questions about your pharmacy benefits, call Navitus Customer Care at 1-866-333-2757.

- If you are an Eastern Wisconsin colleague, beginning December 1, 2017, you can contact Costco at 1-800-607-6861 with mail order questions or to confirm the transfer of your information.

- If you are a Western Wisconsin colleague, you will not be able to see your transferred prescriptions until January 1, 2018.

What if I do not use all of the money in my flexible spending account (FSA) before the deadline?

Based on IRS regulations, you must use all the money in your Dependent Care FSA by December 31, 2024. For the Health Care FSA, HSHS offers a grace period that lets you use your 2024 FSA for expenses incurred up to March 15, 2025. Keep in mind that these time limits apply based on the date of service, not the date billed. For both accounts, you have until May 1, 2025, to claim reimbursement. If you do not, the money left in your account(s) is forfeited.

How can I change my beneficiary for life insurance?

Beneficiary information for life insurance and accidental death insurance is maintained within Workday.

You may review and update your beneficiary information during the annual open enrollment period or at any time during the year by access

Workday.

- Once you log in, click the Benefits tile within the Application section on your Home page.

- Click on Beneficiaries in the Change section to view your current beneficiary elections.

- To update your beneficiaries, click on the Benefit event in the Change section.

- Select the Change Life Insurance Beneficiaries and follow the prompts to update.

- Check your math. Make certain that your primary beneficiary designations total 100%.

How do I file a long term disability (LTD) insurance?

You should begin the LTD claim process in the fifth month of your disability.

- Contact Unum at 866-295-3007 who will advise you of the information necessary for submitting a claim.

- UNUM will also supply you with any required claim forms.

What is the elimination period for short term disability (STD) and can I use PTO during this time?

- The elimination period is a period of continuous disability which must be satisfied before you are eligible to receive STD or EIB benefits.

- The elimination period is seven (7) consecutive calendar days of absence and applies to both STD and EIB.

- You are required to use PTO for any regularly scheduled work days that fall within these seven (7) consecutive calendar days of absence due to your disability, if you have PTO available.

- See the Short Term Disability SPD for more information.

How does the HSHS Employer Contribution Retirement (401(a) Plan) grow?

Your 401(a) plan account grows through:

- HSHS contributions of 3% to 7% of your eligible pay, depending on your years of service.

- Investment earnings.

You are fully vested (100%) in all contributions after

three years of vesting service. HSHS service prior to 2023 counts toward your contribution percentage and your vesting service.

How do I locate a participating VSP provider?

- The VSP network has more than 86,000 locations nationwide and includes vision care providers who participate in the Prevea network. To find a VSP Vision Plan provider, visit www.vsp.com.

- Remember, the VSP network includes Prevea vision providers for the HSHS VSP option.

How do I enroll myself in the LiveWELL program?

Is my pension benefit safe?

Yes! Your pension benefit is safe.

- Hospital Sisters Health System has several checks and balances in place to safeguard your accrued pension benefit.

- Each year your employer deposits funds into a pension plan trust account to cover the pension benefits that have accrued for its employees during the year.

- Each year independent auditors check the books to be sure the funds have been deposited and are being safeguarded.

- HSHS also has pension actuaries who tell us how much money must be deposited each year to provide the benefits that have been accrued and promised.

- The purpose of PTO is to give you maximum flexibility in scheduling time away from work.

- You may use PTO for illness, vacation, holidays, family emergencies, preventive health and dental care, personal business, etc.

- You should schedule your use of PTO in advance whenever possible.

Why doesn’t the annual salary on total compensation statement match my W-2 for last year?

The annual salary amount listed on the total compensation statement does not include any PTO, PTO cash, short term disability, or EIB that you may have received during the year. In order to calculate your total earnings for the year, add the separate balances for EIB, STD, PTO, and PTO Cash to your annual salary.

Who do I contact if I’m unable to log in to PerkSpot?

You can contact PerkSpot Customer Services either by email at

cs@perkspot.com or by phone at (866) 606-6057.

Am I required to use the Pension portal?

No. You still have access to a dedicated HSHS Pension Service Center team who can help you with any questions or needs that you may have. You can contact your Pension Representatives at 1-855-394-4747 – Option #1) Monday – Friday 8:00am – 5:00pm (CST).

How much is contributed to my student loan through the HSHS Student Loan Repayment Program?

- HSHS will contribute $100 per month directly to your student loan servicer for approved and eligible loans.

- The loan must be a qualified education loan in your name and in good standing.

- Lifetime maximum benefit is $18,000.

What types of courses and other expenses are eligible for reimbursement? When is proof of my expenses required?

The program will offer reimbursement for expenses relative to books, fees and tuition less any grants/scholarships.

Courses must be taken for credit through an accredited school or institution and must relate to the completion of a degree program in a discipline that supports the operations of the System, such as healthcare, business, or management to allow for succession planning, talent management, and growth strategies. Certification programs are not eligible under the program.

Proof of costs, including detailed tuition bill and book receipts, are required at the time of application.

What is the Roth contribution option?

A Roth contribution to your retirement savings plan allows you to make after-tax contributions and take any associated earnings completely tax free at retirement - as long as the distribution is a qualified one. A qualified distribution, in this case, is one that is taken at least five tax years after your first Roth 403(b) contribution and after you have attained age 59½, or become disabled or die. Through automatic payroll deduction, you can contribute between 0% and 100% of your eligible pay as designated Roth contributions, up to the annual IRS dollar limits.

Does my manager need to approve my HSHS Education Assistance application?

When an application is completed through the MyHR portal it will automatically route to colleague’s direct manager for approval. Once the manager has approved the application will then route to the HR Service Center for review.

Leader approval ensures that the colleague is in good standing and provides an opportunity for the colleague and their leader to discuss if the courses relate to the completion of a degree program in a discipline that supports the operations of the System, such as healthcare, business, or management to allow for succession planning, talent management, and growth strategies.

Is there a waiting period before I am eligible to use the HSHS Student Loan Repayment Program?

The program is available to eligible colleagues who have completed two full bi-weekly pay periods of active employment. An email invitation will be sent to your HSHS business email account to notify you that you are eligible to participate.

How can I access the HSHS Pension portal?

You can access the portal anytime from anywhere using any device (including mobile) with internet access. Login and register at

http://benefits.hshs.org/pension.

What holidays are included in PTO?

All regular colleagues budgeted to work at least 32 hours per pay are eligible for holidays. You will use accrued PTO on any holiday you would normally be assigned to work. HSHS observes the following holidays:

- New Year’s Day (January 1st)

- Easter (for the purpose of Holiday Premium only)

- Memorial Day (the last Monday in May)

- Independence Day (July 4th)

- Labor Day (the 1st Monday in September)

- Thanksgiving Day (the 4th Thursday in November)

- Christmas Day (December 25th - begins 3:00 pm Christmas Eve)

For areas that are normally closed on Saturday and Sunday, legal holidays falling on Saturday will be observed on Friday and legal holidays falling on Sunday will be observed on Monday.

For areas open on weekends, the legal holiday will be observed on the actual holiday. Non-exempt colleagues working on any of these holidays will be compensated at a premium for the number of hours worked on that holiday (11:00pm – 11:00pm).

Do I need an ID card for my vision insurance through VSP?

- There’s no ID card needed.

- If you’d like a card as a reference, you can print one on www.vsp.com.

- At your appointment, simply tell the provider you have VSP insurance.

How do the HSHS contribution credits work?

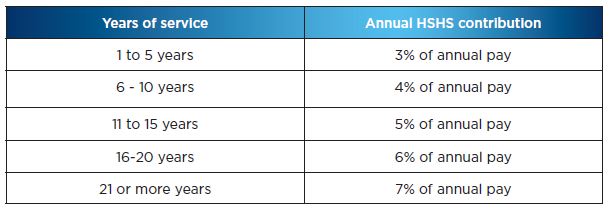

Annual contributions are a percentage of your eligible pay and is the amount HSHS adds to your account for each calendar year in which you are paid for at least 1,000 hours. Your contribution percentage depends on your years of service as of the end of the current year. The following chart shows how contribution percentages for each year are determined based on your service as of December 31 of the current year.

How can I learn more about contributing to a 403(b) Plan and the investment options available to me?

- Access Fidelity NetBenefits NetBenefits.com/atwork to review all the information provided to assist you in making your investment decisions.

- You may also contact Fidelity at 800-343-0860 and ask to speak to an investment representative.

- You can also research the funds on your own or with your financial advisor.

How is the HSHS Final Average Pay Pension benefit paid?

There are two basic forms of HSHS pension benefit payment, depending on your marital status:

- If you are single, the basic form of payment is a monthly income for life, with no survivor benefits.

- If you are married, the basic payment method is a Qualified Joint and Survivor Annuity. Under this form, you will receive a reduced monthly benefit for life. After your death, your spouse will receive benefits for life equal to half the amount you were receiving. Married persons can also elect the basic benefit for single persons if they have spousal consent.

If you do not want one of the basic forms of payment, you may choose one of the optional methods. If you are married, your spouse must consent to your selecting an optional form of payment. His or her consent must be in writing and be witnessed by a notary public. Options available to you are:

- A monthly income for life, with guaranteed payments up to 10 years. Any guaranteed payments remaining at your death will be paid to your beneficiary. If no guaranteed payments remain, there will be no survivor benefit.

- A joint and survivor annuity that pays you a reduced monthly income for life, with either 50 percent, 75 percent, or 100 percent of that amount continuing to your spouse or other designated beneficiary after your death.

Is the HSHS Pension an offset to long term disability (LTD) insurance?

No. Your HSHS Pension benefit is not an offset to your LTD benefit.

How long can I receive short term disability (STD) benefits?

- The maximum period that you may receive STD benefits for the same period of disability is 26 weeks.

- The Short Term Disability Income Protection Plan will not pay more than 26 weeks of STD benefits for a single period of disability.

How do I file a life insurance claim?

Contact the HSHS HR Service Center at 855-394-4747 to initiate your claim. Please have the following information available prior to calling:

- Colleague name and ID number

- Name of deceased and relationship to colleague

- Deceased’s date of birth, date of death, and social security number

The HR Service Center will report this information to Securian who will then contact the colleague or beneficiary.

How can I find out if my medication is on the Navitus formulary and is a preferred medication?

To find out if your medication is on the 2019 formulary, you can view and print the formulary from benefits.hshs.org.

Eastern Wisconsin colleagues can also find the 2019 formulary on www.deancare.com/ASO, and Western Wisconsin colleagues will be able to do so beginning January 1, 2018.

- To view the Navitus formulary, you will need to log in to and create your account on www.deancare.com/ASO.

- Once you click the Navitus logo, you can confirm if your current prescriptions are covered on the Navitus formulary, and at which tier.

- If you are a Western Wisconsin colleague, you may find that the drugs included on Navitus’ formulary drug list may be different from your current formulary.

- Preferred medications on the formulary will be indicated by an “FB” (brand name) or “FG” (generic).

- Non-preferred medications will be indicated by an “NP”.

- Medications that are not covered will be indicated by an “NC”.

Note: Contraceptives are only covered by the HSHS Healthy Plan if they are medically necessary for a purpose other than to prevent conception.

- If you are a Western Wisconsin colleague and you are taking a medically-necessary contraceptive, you will be able to continue your prescription through March 2018, but your provider will need to submit a request to Navitus to continue this prescription on a medically-necessary basis during this time.

All Wisconsin colleagues can call Navitus Customer Care toll-free at 1-866-333-2757 for information about the formulary or other assistance.

for information about the formulary or other assistance.

How do I register with the Express Scripts website?

- Beginning 1/1/2017, visit www.Express-Scripts.com to register.

- You will be asked to provide your Express Scripts ID number and email address.

How can I benefit from using a Network Primary Care Physician (PCP)?

- When you receive care from a network PCP, there’s no deductible and care will be covered at 95% with no office visit copayment.

- More importantly, your Primary Care Physician is the quarterback of your healthcare team.

- A PCP can help you maintain and improve your health and provide direction for any specialist care you need.

How is a claim for removal of impacted wisdom teeth handled?

In the event you and/or your covered dependents have both health insurance and dental insurance coverage, expenses for the extraction (removal) or excision (surgical removal) of impacted teeth are covered first under the HSHS Healthy Plan (health insurance).

- Ask that your oral surgeon or dentist first submit claims for this service to Healthy Choices if you reside in Illinois/outside of Wisconsin or Dean Health Plan if you reside in Wisconsin.

- Once your claim for the removal of impacted teeth has been processed by Healhty Choices or Dean Health Plan, your oral surgeon or dentist’s office should then submit any expenses not paid by the health insurance plan to Cigna for processing by the dental insurance plan.

How do I find out if a dental procedure, service, or device is covered by the HSHS Dental Insurance

There are several options available to you to confirm coverage.

- Contact Cigna’s customer service at 800-244-6224

. Cigna customer service agents may be able to verify coverage.

. Cigna customer service agents may be able to verify coverage.

- Refer to the Dental Insurance Plan summary plan description (SPD). The SPD contains detailed information about the Plan including covered services and Plan exclusions and limitations.

- Ask your dental provider to contact Cigna and request a pre-determination of benefits. Provider offices are often experienced with confirming coverage with insurance companies.

How do I find an in-network provider (Dean Health/Prevea360)?

To locate an in-network provider, CLICK HERE.

For help determining which network service area you are in, see the 2024 HSHS Benefits Guide.

If you have a dependent that does not live in the Prevea360 service area, such as a child attending college, you can register your dependent with Dean Health Plan after you receive your Dean Health Plan ID card.

Call Dean Health Plan to get started. Once your dependent is registered, the First Health network will apply for your dependent’s medical plan coverage.

What is a preferred drug list or formulary? How can I find out if my medication is on this list?

A preferred drug list or formulary is a list of approved drugs for which the HSHS Healthy Plan provides preferred benefits. The preferred drug list is compiled by an independent group of doctors and pharmacists selected by Express Scripts and includes both conventional and specialty medications. Express Scripts reviews nearly 300 drug classes each year to approve medications that are both clinically appropriate and less costly for the HSHS Healthy Plan and its members.

When you receive up to a 30-day supply of medication that is not on the Express Scripts preferred drug list from a retail pharmacy, you will pay an additional $15 copay, or an additional $45 copay for up to a 90-day supply under the mail service option.

To find out if your medication is on the list, you can call 1-800-698-3757 or use the Formulary look up feature on www.express-scripts.com.

What are the specialty medications that need to be filled through Lumicera?

Specialty medications are generally prescribed for people with complex or ongoing medical conditions such as multiple sclerosis, hemophilia, hepatitis, and rheumatoid arthritis. These high cost medications typically also have one or more of the following characteristics: injected or infused, but some may be taken by mouth; have unique storage or shipment requirements; require additional education and support from a health care professional; or usually not stocked at retail pharmacies.

Remember that your initial prescription for a specialty drug may be filled at a retail pharmacy. After that, you must use Lumicera or an HSHS pharmacy in order for subsequent refills to be covered. Lumicera can deliver the specialty medication and supplies to your home, doctor’s office or any other location. They also provide access to pharmacists and nurses who can answer your questions about your specialty drugs.

Note: For Western Wisconsin colleagues, most prescriptions for current specialty medications will automatically transfer to Lumicera.

What is life insurance portability and/or conversion? What are the differences between the two?

Portability allows you to continue your Basic Life, Supplemental Group Term Life (SGTL) insurance, and Accidental Death & Dismemberment insurance for yourself and any covered family members when coverage is lost due to retirement, termination of employment, layoff, non-medical leave, or loss of eligibility. You pay the total cost of premiums directly to Securian (formerly known as Minnesota Life). You may continue your total amount of insurance coverage that was in effect on the date your coverage ended, up to a maximum of $500,000. If you are age 65 or older, the amount you may “port” will be 65% of the amount of insurance in force on the date your coverage ended. Portability ends at age 70.

Conversion allows you to continue your Basic and/or Supplemental Group Term Life (SGTL) insurance coverage as an individual insurance policy for yourself only when coverage is lost due to retirement, termination of employment, layoff, leave of absence (including medical leave), or loss of eligibility. You pay the total cost of premiums directly to Securian (formerly known as Minnesota Life). There is no age reduction of coverage at age 65 and there is no age limitation for the conversion option.

The basic differences between portability and conversion of life insurance are:

- Portability has an age limit of 70. There is no age limit with conversion.

- Portability has a reduction in coverage at age 65. There is no reduction of coverage based on age with conversion.

- Portability is coverage under the group term life contract. Conversion is a new individual life insurance policy.

- Portability is not allowed for a medical leave of absence (disability). Conversion does not have this restriction.

- Portability allows for continuing life insurance coverage for family members. Conversion is limited to coverage for the colleague only.

- Coverage cannot be increased with the portability option. Coverage may be increased with evidence of insurability (EOI) with the conversion option.

- Coverage can be decreased if you choose either portability or conversion.

Can I use PTO to supplement short term disability (STD) benefits so that I can receive 100% of my pay?

Yes, if you have PTO available, you may choose to use some of your PTO hours, so that in combination with your STD benefit, you receive 100% of your base pay.

- For example, if you receive STD benefits for a week and you are regularly scheduled (budgeted) to work 40 hours a week, the STD plan would pay 70% of pay; that equates to 28 hours. You could use 12 hours of PTO that week to bring your pay to 100%.

Can I continue my long term disability insurance (LTD) coverage if I retire?

Because the purpose of LTD insurance is to provide money to you in the event you cannot work due to being disabled, the LTD insurance coverage ends when you retire.

If I was hired or rehired on or after July 1, 2014, what contributions are made to my 403(b) Plan account?

Your 403(b) Plan account grows through:

- Your contributions- up to 100% of your pay up to IRS limits ($23,000 in 2024, or $30,500 if age 50 or older)

- HSHS matching contributions - 50 cents for every dollar you contribute up to 4% of your pay (subject to IRS limits, $345,000 in 2024)

- Investment earnings

You are always fully vested (100%) in all contributions.

What vision discount programs are available to benefit eligible colleagues?

For those colleagues enrolled in the Cigna Dental Plan

Answer: Cigna Healthy Rewards. Present your Cigna dental card at time of service for applicable discount.

- To find a Cigna Healthy Rewards vision provider, click here or call 1-800-870-3470.

- For help on registering on the Cigna site, call 1-800-853-2713.

- For more information on Cigna’s vision discount program through Cigna’s Healthy Rewards program, click here.

What happens to my PTO time if I transfer to another HSHS facility?

If you transfer to another HSHS facility, you have the option of transferring all of your accumulated PTO hours (and EIB hours if applicable) to the receiving organization or you may receive payment for your accumulated PTO and transfer only the EIB hours if applicable, or a combination of some PTO hours paid out and some transferred.

How and when can I receive my 401(a) Plan balance?

If you are vested with three years of vesting service, you may receive your benefit when you terminate employment with HSHS. You may take a lump sum or an alternate form available from Fidelity, such as installments. You can also delay distribution to a later date.

What is required to register my account?

As part of the registration process, you will be prompted to set up a username and password. Your username must be an active email address that you are able to access, and your password will need to meet a minimum set of requirements, which will be specified during the registration process. As part of our Multifactor Authentication process, you will also be asked to provide at least one secondary contact method. This can either be another email address or a phone number that can be used to send a temporary numeric code to validate your identity,

What is the deadline for submitting the Student Loan Repayment application and how quickly will I see my first payment?

Applications must be received by the 10th of the month to be considered for HSHS contributions starting the following month.

- Example: When an application is submitted and approved by December 10, 2023, the first HSHS contribution will take place in January 2024.

What is the deadline for submitting an Education Assistance Application?

Fully completed and approved applications must be received on or before the course start date to be considered for education assistance. Proof of costs is also required at time of application.

Reimbursement will only be made upon completion of a course. Proof of grades must be submitted within 3 weeks of completing the course(s).

Is the HSHS Final Average Pay Pension Plan freezing?

Active colleagues under the HSHS Traditional FAP Pension Plan (hired prior to July 1, 2014) will have their pension benefits frozen as of December 31, 2023. Starting January 1, 2024, they will stop earning additional benefits in the HSHS FAP Pension Plan and will become eligible for the HSHS Employer Contribution Retirement 401(a) Plan and matching employer contributions to the 403(b) Plan, both managed entirely by Fidelity Investments.

Reminder: Because colleagues may have earned an additional year of service toward their benefit for 2023, an exact pension lump sum present value calculation will not be available until the end of January/early February. Colleagues going through the transition will be sent additional information to their home mailing address in late January/early February informing of their final pension benefit, information on their new 401(a) and 403(b) match benefit, and a timeline for next steps and important dates.

How and when will I receive reimbursement?

Education Assistance payments will be issued through payroll within 3 pay periods of receipt and verification of final grades.

Payments will be treated as non-taxable income to the colleague. The amount may be reported on the colleague's Form W-2 as educational assistance in Box 14. This does not denote taxable income, but rather is provided for informational purposes.

Can I use HSHS pharmacies to obtain a 90-day supply of medications I take regularly?

Yes, you can have your prescription filled at an HSHS pharmacy for a 90-day supply.

Do I have to repay my student loan payments if I leave HSHS?

No. However, if you leave employment with HSHS or become ineligible for the program your monthly contributions will cease immediately.

Will I still have access to the HSHS Pension Portal if I retire or leave employment from HSHS?

Yes. If you are a vested participant in the HSHS Pension Plan (Traditional), you will continue to have access to your HSHS Pension benefits until 7/1/2024.

Is my privacy protected in the HSHS LiveWELL program?

Yes! Your personal health information is important and should be kept confidential. That is why HSHS has a strict policy in place to protect your privacy rights. Your individual information is held in strict confidence between you and Limeade. The only information HSHS can receive is collective data about its population as a whole, not any individual health information. Your privacy is ensured, in compliance with the Health Insurance Portability and Accountability Act (HIPAA) of 1996, which prohibits anyone at your company from receiving your personal health information without your permission. For more information on the Privacy Policy, please login at

http://hshs.limeade.com.

I worked for HSHS, left employment and was later rehired, does my prior service count towards vesting in the HSHS Employer Contribution Retirement (401(a) Plan)?

If you are rehired on or after July 1, 2014, you are eligible to begin earning a 401(a) plan benefit as described in this guide if you are employed on or after January 1, 2023. Any previous years of service for which you retain credit will count toward vesting in the 401(a) plan benefit and the annual HSHS contribution percentage.

Do I have to participate in the 403b retirement saving plan?

- To encourage early investing and simplify the 403(b) Plan enrollment process, all eligible HSHS colleagues hired or rehired with HSHS on or after July 1, 2014 are enrolled automatically at a 4% of pay contribution level after 60 days of employment.

- Unless you choose otherwise, your contribution level will continue to increase by 1% each year until you’re eventually contributing 8% of your pay.

- These automatic contributions will be invested in the Vanguard Target Retirement Funds based on your date of birth, unless you choose different investment options.

- You can increase, decrease, or stop your contributions at any time.

How do I access my Flexible Spending Account (FSA) information?

2024 Contributions will need to be submitted to Health Equity.

For 2023 Contributions - After your FSA enrollment information is reported to Tri-Star by HSHS, your account information is available through the Tri-Star website at www.tri-starsystems.com. To access your account you will need to click on “My Account” to be brought to the secure login page. Once there, you will type your email address for the user name in the box. Next, you need to type in your Tri-Star password & click Login.

If you have never enrolled previously or you are having trouble logging in you will need to contact Tri-Star customer service at 1-800-727-0182, option #1 to provide a valid email address. Once you have provided the customer service representative your email address you will need to initiate the password reset process at the Tri-Star login page. You can do this by clicking on the link “I forgot my Password or I never received one”. The next screen that will be populated will ask you for your email address and once you provide that you can click Submit. You should receive an e-mail from Tri-Star regarding your password. If the email address provided matches what Tri-Star has on file, a time-sensitive link will be sent to that email address instructing you on how to reset your password. Following the link contained in the email you will be required to answer security questions before being allowed access to your account.

Once you have accessed your account, you can:

- E-file or view claims for either or both of your Health Care Reimbursement Account and Dependent Care Reimbursement Account.

- View details of FSA claims paid, such as date of payment, payment type, and amount.

- View your account summary which provides a balance of the funds that are available.

- Set up or change direct deposit information for FSA reimbursement purposes.

- Enter the Benny Card system site to check approval status of card use, card payments awaiting documentation from you and other card information.

For a more in-depth guide to learn or review how to use Tri-Star’s system you can access the How-To Guide by clicking here.

What about emergency room care?

You will have a $100 copayment for emergency services. This is in addition to your deductible and coinsurance for the medical plan option you select.

If my doctor recommends that I receive care form a non-network provider, will that care be covered?

Out-of-network services will not be covered unless you first obtain a referral from your network provider and prior authorization from Dean Health Plan. Your network provider will need to submit a referral request to Dean Health. If you have questions about the referral process, contact Dean Health Plan at 1-888-895-1188.

What if I need care from a non-network provider?

Out-of-network services will not be covered unless you first obtain a referral from your provider and prior authorization from URM. Your provider will need to submit a referral request to UMR. If you have questions about the referral process, contact UMR at 1-800-221-6346.

What is the HealthEquity Visa Health Account Card? What is the advantage of using this card?

The HealthEquity Visa Health Account card works like a debit card for eligible health care FSA expenses. Use it to pay for eligible expenses at the pharmacy, including OptumRx for maintenance medications, hospital or your doctor or other health care provider’s office. Through the card, you access money you have elected to set aside each pay period in your health care FSA.

When you pay for eligible health care expenses with this card, you do not have to use your own money up front and then wait for reimbursement. The card also gives you the ability to purchase qualified over-the-counter items such as nicotine gum or patches that are not eligible for reimbursement through manual claim submission.

It’s important to keep all documentation related to each expense you have in case the documentation is requested by the IRS or HealthEquity s to substantiate your claims.

Only use the debit card for expenses that have not and will not be paid by the HSHS Medical Plan, HSHS Dental Plan, and/or VSP Vision Plan by the option(s) in which you are enrolled.

How does the HSHS matching contribution work?

- HSHS contributes 50 cents for every dollar you contribute on the first 4% of your eligible pay (pay shown on your W-2 statement plus any pre-tax contributions you make for benefits, including the 403(b) Plan; subject to IRS limits, $345,000 in 2024).

- Contributions that are made in each calendar year in which you are paid for at least 1,000 hours are matched, as long as you are actively employed on December 31 of that year.

- The maximum match you can receive in a calendar year is 2% of eligible pay.

- Colleagues terminating employment during the year due to death, disability, or after reaching age 55 are also eligible to receive matching contributions.

What information does the formulary include?

The formulary is a list of commonly prescribed medications covered by your plan. It also:

• Identifies medications for certain conditions and organizes them into cost levels called tiers

• Lets you know if any medications require prior authorization or step therapy, which may affect how they are covered

• Includes additional information about (medications that may have quantity/supply limits or be considered specialty

To see if your medication is covered under OptumRx, check the current formulary, by clicking

HERE.

What is my commitment under the Education Assistance Program? Am I required to repay the amount issued to me if I change status (below 32 hours per pay period/PRN) or leave HSHS?

In the event a colleague terminates employment (voluntarily or involuntarily), reduces his/her hours less than 32 hours per pay period or transfers to PRN status within one year of receiving Education Assistance, the colleague agrees to repay a prorated amount of the education assistance paid by HSHS.

What is the process for applying for and receiving Education Assistance?

Process

Step 1: Policy Review

- Review HSHS Education Assistance policy available on HSHS intranet.

- Review discounts available at colleges/universities participating in the HSHS Discount Program/PerkSpot.

Step 2: Application, Supporting Documentation Submission, and Approval*

- Complete the Education Assistance Application, found on MyHR, in its entirety.

- Gather required documents which include course schedule and tuition bill and, if applicable, detailed receipts for required textbooks.

- If applicable, gather required documentation for grants, scholarships or other financial assistance being received that do not require repayment.

- Submit fully completed application and required documents prior to beginning the courses.

- Upon submission, your application will be routed to your leader for approval.

- Once your application is approved by your leader, it will be sent to the HR Service Center for review and processing. Processing updates will be sent to your HSHS email and available in MyHR.

IMPORTANT: Completed applications and all required supporting documentation must be received by the HSHS HR Service Center on or prior to the course start date to be considered for payment.

Step 3: Final Grades*

- Submit Education Assistance Reimbursement request, found on MyHR, attaching final and verifiable grade report that includes your name, course(s), and grade(s) within 21 days of course completion

Step 4: Receive Payment*

- Education Assistance payments will be issued through payroll and treated as non-taxable income.

- Payments will be issued within 3 pay periods of receipt and verification of final grades.

- The maximum benefit amount allowed under the Education Assistance policy is based on payments made in the calendar year, which may/may not be the same calendar year in which coursework is completed.

*does not apply to Partnership Program

What are the advantages of using OptumRx home delivery?

• Medications will be delivered directly to your door, which means fewer trips to the pharmacy.

• You will receive up to a 90-day supply, which may save you money on copays

• Pharmacists will be available by phone 24 hours a day, 7 days a week to answer questions.

• You can set up automatic reminders to help you remember when to take your medication and refill your prescriptions.

• Enroll in our Hassle-Free FillSM program and we’ll automatically refill and deliver your eligible maintenance medications to you.

Can I move money from another retirement plan into my account in the HSHS 403(b) Plan?

You are permitted to roll over eligible pretax contributions from another 401(k) plan, Roth 401(k) plan, 401(a) plan, 403(b) plan, Roth 403(b) plan, governmental 457(b) retirement plan, or a Roth 457(b) retirement plan account or eligible pretax contributions from conduit individual retirement accounts (IRAs). A conduit IRA is one that contains only money rolled over from an employer-sponsored retirement plan that has not been mixed with regular IRA contributions.

Additional information can be obtained online, or by calling the Fidelity Retirement Benefits Line at 1-800-343-0860.

Why do I need to submit receipts or copies of claims or medical bills to Tri-Star/Health Equity?

The IRS requires proof that the expense was qualified for reimbursement through a health care FSA.

For 2023 contributions, receipts/proof will be submitted to Tri-Star Systems and they will request documentation from you in order to substantiate your claim.

For 2024 contributions, receipts/proof will be submitted to Health Equity our new third party administrator for and they will request documentation from you in order to substantiate your claim.

Is there a limit to the amount I can contribute to the 403b retirement savings plan in 2024?

For calendar year 2024, the maximum elective contributions are:

- For a participant who is under age 50, the maximum contribution is $23,000.

- For a participant who is age 50+, the maximum contribution is $30,500.

What happens to my FSA if I leave HSHS?

If you are leaving HSHS you may still submit claims for both the health care and/or the dependent care FSA.

Health Care FSA:

- Claims for services received through your employment end date are eligible for reimbursement.

- Qualifying health care claims must be filed with Tri-Star Systems (2023 contributions) or Health Equity (2024 contributions) by May 1 of the year following the plan year in which you contributed to the spending account.

- Your debit card will be automatically canceled on your employment end date.

- You will need to submit claims directly to Tri-Star (2023 contributions) or Health Equity (2024 contrtibutions) for reimbursement.

Dependent Care FSA:

- Claims may be submitted for dependent care expenses up to the amount in your account at your employment end date and must be incurred prior to your employment end date.

- Qualifying dependent care claims must be filed with Tri-Star Systems (2023 contributions) or Health Equity (2024 contributions) by May 1 of the year following the plan year in which you contributed to the spending account.

- If you did not have any qualifying dependent care expenses as of the day your employment ends, you are not eligible to file any claims for reimbursement per IRS regulations.

Where can I fill my specialty prescription?

You can fill your prescription at Optum® Specialty Pharmacy. Our patient care coordinators and pharmacists are trained to understand your special therapy needs.

How do I order my prescriptions from OptumRx home delivery?

- By e-prescribe. Your doctor can send an electronic prescription to OptumRx

- Go online. Visit the website on your member ID card

- By mobile app. Open the OptumRx app, which you can download from the Apple® App Store® or Google Play™

- By phone. Call the toll-free number on your member ID card

What are specialty medications?

Specialty medications treat chronic conditions such as cancer, multiple sclerosis and rheumatoid arthritis. It can be an injectable, oral or inhaled medication with one or more of the following characteristics:

• May require ongoing clinical oversight and additional education for best management

• Have unique storage or shipping requirements

• May not be available at retail pharmacies