HSHS Retirement Program

The HSHS Retirement Program has multiple elements that reflect both the HSHS commitment to make significant employer contributions to your retirement savings and the opportunity for you to meet your own savings goals.

The HSHS retirement program includes the:

- HSHS Employer Contribution Retirement Plan (“401(a) Plan”), consisting of HSHS employer contributions only. In this plan, HSHS contributes to your retirement savings whether you are able to or not. Your participation/enrollment in the 401(a) Plan is automatic. The HSHS employer contribution ranges from 3%-7% of your eligible pay based on your years of service.

- HSHS 403(b) Retirement Savings Plan (“403(b) Plan”) with matching contributions from HSHS. You can elect to contribute to your own retirement savings and HSHS will match 50¢ for every $1 you save on the first 4% of your eligible pay.

You direct how your accounts in the plans are invested by choosing from the investment options offered by Fidelity Investments, the recordkeeper and investment provider.

401(a) and 403(b) Plan Eligibility

Colleagues of HSHS and its participating affiliates are eligible for the HSHS retirement program.

The following colleagues are not eligible:

- Colleagues who are members of a collective bargaining unit whose contract does not provide for membership in the HSHS 401(a) Plan.

- Temporary or leased colleagues, as classified by the Internal Revenue Service.

Medical residents are not eligible for 401(a) Plan benefits. However, they can participate in the non-matching HSHS 403(b) Retirement Savings Plan.

Watch the video below to see how the two different plans combined contribute to your overall retirement savings and offer our colleagues at HSHS a great retirement benefit.

Employer Contribution Retirement Plan (401(a) Plan)

The HSHS Employer Contribution Retirement Plan (401(a) Plan) is an important source of your overall retirement income – funded entirely by HSHS. It rewards your service with higher contributions as your years of service increase and forms the foundation of the retirement income you build. If eligible, you are automatically enrolled.

Your 401(a) Plan account grows through:

- HSHS contributions of 3% to 7% of your eligible pay, depending on your years of service.

- Investment earnings.

You are fully vested (100%) in all contributions after

three years of vesting service. HSHS service prior to becoming a participant in the 401(a) counts towards your contribution percentage and your vesting service.

How HSHS Contributions Work

You earn a year of service for both vesting and your contribution percentage for each calendar year you are paid for at least 1,000 hours. To receive the annual contribution, you must be actively employed by HSHS on December 31 of the plan year and have worked at least 1,000 hours during the plan year, unless you terminate with HSHS after reaching normal retirement age (65), die or become disabled (as defined by the plan).

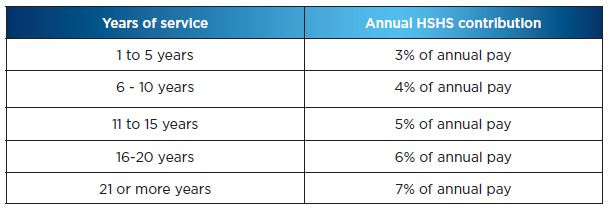

The following chart shows how contribution percentages for each year are determined based on your service as of December 31 of the plan year.

Timing of Contributions

Timing of Contributions

Employer contributions to the 401(a) Plan are made each Spring, based on hours worked and earnings earned in the previous year.

403(b) Retirement Savings Plan

The HSHS 403(b) Plan gives you the opportunity to build on the foundation of your 401(a) Plan benefit. It’s an important source of your overall retirement income.

Your 403(b) Plan account grows through:

- Your contributions – up to 100% of your pay up to IRS limits ($23,500 in 2025, or $31,000 if age 50 or older).

- HSHS matching contributions – 50 cents for every dollar you contribute up to 4% of your pay (subject to IRS limits, $350,000 in 2025)

- Investment earnings.

You are always fully vested (100%) in all contributions.

Automatic Enrollment – 60 Days After Hire Date

At HSHS, we believe that retirement saving is part of financial well-being – with active planning and investing at every stage in your career. To encourage early investing and simplify the 403(b) Plan enrollment process, all eligible HSHS colleagues upon hire or rehire are enrolled automatically 60 days after their date of hire at a 4% of pay contribution level. And unless you choose otherwise, your contribution level will continue to increase by 1% each year until you’re eventually contributing 8% of your pay.

These automatic contributions will be invested in the Vanguard Target Retirement Funds based on your date of birth, unless you choose different investment options.

You can increase, decrease, or stop your contributions at any time.

How The Match Works

HSHS contributes 50 cents for every dollar you contribute on the first 4% of your eligible pay. Contributions that are made in each calendar year in which you are paid for at least 1,000 hours are matched, if you are actively employed on December 31st of that year. The maximum match you can receive in a calendar year is 2% of eligible pay. Colleagues terminating employment during the year due to death, disability, or after reaching age 55 are also eligible to receive matching contributions.

Timing of Contributions

Employer matching contributions to the 403(b) Plan are made each Spring, based on colleague contributions from the previous year.

401(a) and 403(b) Plan Distribution Options

Your account from each plan may be distributed to you when you terminate employment with HSHS. To defer taxes and avoid penalties for early withdrawal, your account balance may be rolled over directly to an Individual Retirement Account (IRA) or another qualified employer plan that allows rollovers. You also may take a lump sum or an alternate form available from Fidelity, such as installments.

Due to IRS rules regarding required minimum distributions, you may be required to take distributions beginning at age 72. As long as you are eligible and actively employed at HSHS, you can continue to participate in the plans, even past age 72, and you do not have to take a distribution.

If you are age 59½ or older, you can withdraw your employee contributions and any rollover contributions to the 403(b) plan while still working at HSHS. The 403(b) plan also offers you access to your money while you are still employed by HSHS through a loan. In some cases, you also may be eligible for a hardship withdrawal. For the 401(a) plan, however, loans or in-service withdrawals are not allowed.

Additional Retirement Plan Resources

Schedule a Complimentary 1:1 Appointment

As you consider your retirement goals and financial objectives, we encourage you to explore the resources available to you. Whether you have questions about contribution options, investment strategies, or retirement readiness, our team along with Fidelity is here to help support you at every step in your journey. If you are interested in scheduling a 1:1 with a Fidelity Workplace Financial Consultant, either in-person or virtually, you can do so by clicking

HERE or by entering the following URL:

http://Fidelity.com/schedule.