Leaving HSHS

HSHS has created the HSHS Offboarding portal to assist you with common questions you may have as you leave employment with HSHS. If you have any questions that you are not able to find within this portal, our HSHS HR Team is here to assist you. You can reach one of our HR Representatives at the HR Service Center directly at 1-855-394-4747.

______________________________________________________________________________

Submitting a Resignation

In the event you decide to leave HSHS, you should submit a written notice to your leader as soon as a decision to leave is made. The notice should reflect the last day of work and reason for separation.

HSHS requests a one month written notice for any leader, salaried and/or licensed professional. A

two-week written notice is expected for all other colleagues. HSHS reserves the right to accelerate a colleague’s departure at its discretion and will pay the colleague through the notice period. Paid Time Off (PTO) hours may not be utilized as notice of termination. The termination date will be the colleague's last day of work.

If you are retiring and have questions regarding your HSHS Pension benefit(s) or would like to begin receiving your benefit, please reach out to Fidelity at 800-343-0860.

______________________________________________________________________________

Final Paycheck and PTO Payout

Your final regular paycheck will be direct deposited into your account(s) on record at the time your employment ends. The deposit will occur on the regularly scheduled pay date for the pay period that includes your termination date. Your final paycheck will include payment for hours worked/salary up through your termination date as well as payment for any accrued and unused paid time off (PTO) hours. Extended Illness Benefit (EIB) hours are NOT payable upon termination.

Final Regular Paycheck Deductions

- Voluntary contributions to 403(b)/457(b), United Way, Foundation, colleague assistance programs, etc. will be deducted.

- Cafeteria, gift shop and/or other charges using your badge and/or by other payroll deduction authorizations made on or prior to your termination date will be withheld from your final regular paycheck.

- Legally required deductions such as child support and wage garnishments will be deducted from your final regular paycheck.

- Insurance benefit premiums will be deducted from your final regular paycheck to pay for coverage until the end of the month in which employment is terminated. If your termination date is early in the month, you may see additional premiums that are due for the remainder of the month.

- All applicable income tax withholdings.

______________________________________________________________________________

Updating Personal Information with HSHS

To update any of your personal information before leaving HSHS, to include home mailing address, direct deposit information or Federal/State withholdings, access your colleague profile within Workday and make the necessary updates to your profile.

HSHS Workday Employee Guide

______________________________________________________________________________

Access Past Statements through ADP

Former colleagues of HSHS may view pay statements and annual statements (W-2’s) through the ADP online portal. To access the portal, you will need:

- Access the website https://my.adp.com

- Organizational Registration Code: HSHS1-myadp.

The portal will include all pay statements from 2022 and after. For assistance registering on the ADP portal, please refer to the ADP Employee Self Service Registration document here.

______________________________________________________________________________

Exit Interview Information

We care about your work experience with us and want to make our organization an even better place to work. We are partnering with People Element, a third-party organization, to conduct exit interviews on our behalf.

You may complete your exit interview online or over the phone. If we have a personal email address on file for you, you will receive an email from People Element with instructions for completing your exit interview online. If you do not complete your exit interview online, People Element will also try to call you. Please note that you do not need to take any action; People Element will contact you following your departure from HSHS.

If you prefer to reach out to People Element directly to obtain your unique link to access the exit interview online, or if you would like to provide your feedback over the phone, please call (800) 765-6186 after your exit date. People Element interviewers are available to take your call Monday through Friday from 8:00 am to 7:00 pm and by appointment on weekends.

STRICTLY CONFIDENTIAL

The information you provide in your exit interview will be kept confidential, so please provide your honest feedback.

YOUR FEEDBACK CAN ASSIST US IN:

• Improving the work environment for your former colleagues

• Identifying what we do well, and how we can improve

• Helping the organization continue to develop and grow

PEOPLE ELEMENT NEEDS TO REACH YOU

To ensure People Element is able to contact you, please make sure we have your current personal email address and phone number on file.

If you have any questions or concerns about this process, please contact Human Resources.

800.765.6186

[email protected]

www.peopleelement.com

______________________________________________________________________________

Continuation of HSHS Benefits Coverage

If you are enrolled in any HSHS benefits at the time your employment ends, coverage will end on the last day of the month in which employment is terminated. Additional information to continue group insurance benefits will be mailed to your home address.

Medical Plan:

You and your covered dependents can continue your medical insurance coverage up to 18 months if you are covered for the previous three months before you separate, and you are under the age of 65. If you are over the age of 65, your dependents who remain under the age of 65 can be offered their own policy under the HSHS Continuation plan. You will be responsible for the full premium amount.

Dental Plan:

You and your covered dependents can continue your dental insurance coverage up to 18 months if you are covered for the previous three months before you separate. You will be responsible for the full premium amount.

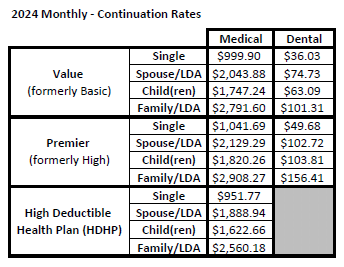

2024 and 2025 Medical and Dental Insurance Continuation Monthly Premiums

Voluntary Benefits - Portability

You can maintain the following voluntary benefits following the end of your employment by converting or porting to an individual policy with the insurer. For more information or to enroll, contact the respective insurer referenced below:

______________________________________________________________________________

HSHS Retirement Benefits

HSHS 403(b) Retirement Savings Plan:

Colleagues who separate employment from HSHS have many options available to them when it comes to what you can do with your funds. You may elect to:

- Leave your funds with Fidelity Investments.

- Roll over your savings into an IRA (Individual Retirement Account) offered by Fidelity or another financial services provider.

- Roll over your savings into another employer's plan.

- Cash out your savings (this would be considered a "taxable event")

Required Minimum Distributions: Terminating participants who are at least age 70.5 (age 72 if attained age 70.5 after December 31, 2019) generally must take a required minimum distribution (RMD) from the Plan by April 1 of the subsequent year.

Questions: To learn more about your options, we encourage you to log into your Fidelity NetBenefits account, by clicking

HERE or by calling a Fidelity at 800-343-0860.

HSHS 457(b) Retirement Savings Plan (If Eligible):

Colleagues who separate employment from HSHS will receive paperwork from Fidelity about your distribution options. Distribution of your account will occur no later than 60 days following your termination date. You may elect to:

- Receive payment of the balance of your account in a lump sum, on a future date that you select.

- Receive payment of the balance of your account beginning on a future date that you elect in monthly, quarterly, semi-annually, or annual installments over 1 to 20 years.

- Transfer on a tax-free basis payment of the balance of your account to a 457(b) plan sponsored by another tax-exempt organization that accepts 457(b) plan transfers.

Action Required: If you do not make an election as outlined above, the plan will pay you a lump sum on the first day of the first calendar month commencing after the date that is four months after you separate from service, or as soon as practicable thereafter.

HSHS Employer Contribution Retirement Program ("401(a) Plan")

The HSHS Employer Contribution Retirement Plan (401(a) Plan) is an important source of your overall retirement income – funded entirely by HSHS. In this plan, HSHS contributes to your retirement savings whether you are able to or not. Your participation/enrollment in the 401(a) Plan is automatic.

The HSHS employer contribution ranges from 3%-7% of your eligible pay based on your years of service. HSHS rewards your service with higher contributions as your years of service increase and forms the foundation of the retirement income you build.

Distributions

Your account from this plan may be distributed to you when you terminate employment with HSHS. To defer taxes and avoid penalties for early withdrawal, your account balance may be rolled over directly to an Individual Retirement Account (IRA) or another qualified employer plan that allows rollovers. You also may take a lump sum or an alternate form available from Fidelity, such as installments.

Due to IRS rules regarding required minimum distributions, you may be required to take distributions beginning at age 72 if you decide to leave your funds with HSHS upon termination.

______________________________________________________________________________

HSHS Flex Spending Accounts and Health Savings Accounts:

If you are leaving HSHS you may still submit claims for both the health care and/or the dependent care FSA as well as the Health Savings Account (HSA).

Health Care FSA

Dependent Care FSA

- Claims for services incurred on or before your benefit termination date are eligible for reimbursement.

- Claims may be submitted for dependent care expenses up to the amount in your account at your employment end date and must be incurred prior to your employment end date.

- Qualifying dependent care claims must be filed with HealthEquity by May 1 of the year following the plan year in which you contributed to the spending account.

Health Savings HSA

- Colleagues enrolled in the High Deductible Health Plan with HSA are eligible to utilize a health savings account (HSA) offered through HealthEquity.

- Unlike Flexible Spending Accounts (FSA), you own your HSA. That means your entire balance rolls over every year and your funds never expire, even if you change health plans, retire, or leave employment.

- After your employment ends, you will be responsible to pay any monthly admin fees on the account. This is currently $3.95 per month.

- Colleagues can continue to use their existing debit card even after employment ends.

- Visit the HSHS HealthEquity resource page for many resources on how HSA's work.

______________________________________________________________________________

HSHS Rewards & Recognition Program

At HSHS, we appreciate our dedicated colleagues and are proud to recognize them for their work and commitment to our mission and organization. As a colleague, you may have received recognition through the

HSHS Appreciation Hub and been awarded recognition points. These points were automatically deposited into your account and can be redeemed for a wide array of gifts including merchandise, gift cards, and much more.

To redeem your points online, access the

HSHS Appreciation Hub and enter your username and password. Your username is your 6-digit HSHS Employee ID number. To redeem your points by phone, please call 1-800-337-8915 and refer to HSHS as your sponsoring company.

Note: Upon termination of employment, points will be voided after 15 days.

______________________________________________________________________________

Social Security Administration Office/Medicare Coverage

If you are over the age of 65 (or turning 65 in the next 3 months) and are not actively receiving benefits from Social Security, we encourage you to sign up for Medicare through Social Security. You can either sign up for Medicare online by visiting

medicare.gov or by contacting your local Social Security Administration Office. To find locations near you, visit

ssa.gov.

.jpg?width=350&height=183)

_____________________________________________________________________________

Unemployment Benefits

To discuss your options surrounding unemployment benefits, please click below to access the Illinois and Wisconsin unemployment notices or visit your local state unemployment website. If you are a remote worker who resides outside of Illinois or Wisconsin, please contact your state's unemployment office.

Illinois Unemployment Notice Wisconsin Unemployment Notice

.jpg?width=200&height=155)

.gif?width=225&height=81)

Illinois Department of Security Wisconsin Department of Workforce Development

Phone: (800) 244-5631 Phone: (608) 266-3131

http://www2.illinois.gov/ides https://dwd.wisconsin.gov/ui/